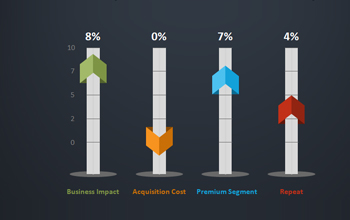

Grew annuity business of a life-insurer by 7%

Built multiple statistical models that qualified leads from credit bureau. With the newly developed acquisition strategy, the insurer was able to grow their new premiums by 7% keeping the same acquisition cost.