Reduced cost of acquisitions by 7%

Built direct marketing models using machine learning approach that leveraged credit bureau and applications data

Many technological innovations, over the last few years, have changed the face of banking and investment management. AI has the potential to reinvent banking in the coming years and StratLytics is among the leaders who are developing innovative AI solutions to redefine lending services and investment solutions from end-to-end.

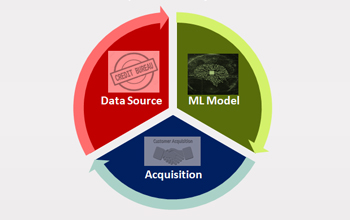

Built direct marketing models using machine learning approach that leveraged credit bureau and applications data

Built acquisition underwriting models using logistic regression that improved the credit losses by 11% for the same approval rate

Built suite of behavior and collection models. Developed new collection strategy that improved collections by 8% through optimal use of collection and legal resources.